The declining balance depreciation method is one of the techniques used to depreciate an asset more quickly during the beginning of its life than at the end. Unlike the straight-line method, the depreciation expense is not the same for every period. Instead, the depreciation expense declines each successive period, as the function’s name indicates.

See a table comparing the different depreciation amounts using all methods and get a copy of the DB function spreadsheet to follow along.

Contents

Related Videos

Purpose of the DB Function

To return the value of one period of declining balance depreciation expense.

Similar Functions

SLN – Straight-line depreciation

SYD – Sum-of-the-years digits depreciation

DDB – Double-declining balance depreciation

Syntax

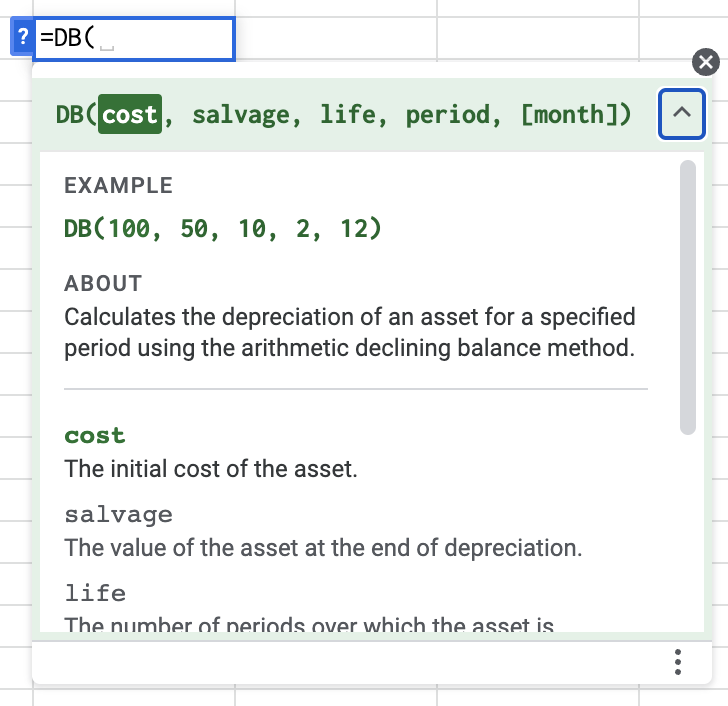

=DB(cost,salvage,life,period,[month])

cost– This is the asset’s acquisition cost, including the purchase price and costs associated with its acquisition, such as freight and sales tax.salvage– The amount you expect to receive in exchange for the asset at the end of its useful life. ⚠️ This formula will not work with a zero in this field.life– The number of accounting periods you expect the asset to be in service.period– The period for which you are calculating depreciation expense.[month]– OPTIONAL. The number of months in the first year of depreciation if it is not a full year.- Note: Be sure that

lifeandperiodare in the same units (months or years).

Examples

Example 1 – Simple Purchase

You purchase an automobile for $40,000 that you expect to last three years and trade in for $4,000.

| A | B | C | |

| 1 | Amount | Parameter | Description |

| 2 | $40,000 | cost | acquisition cost |

| 3 | $4,000 | salvage | money back at the end of its life |

| 4 | 3 | life | number of periods for the useful life |

| 5 | 1 | period | which period the expense is for |

| Formula | Description | Result |

=DB(A2,A3,A4,A5) | Depreciation expense for the first period | $21,440 |

=DB(A2,A3,A4,2) | Depreciation expense for the second period | $9,948 |

=DB(A2,A3,A4,3) | Depreciation expense for the final period | $4,616 |

Notice that the three results add up to 36,004 instead of 36,000. Although this difference would be immaterial to a financial statement user, it could cause problems for bookkeepers trying to balance the accounts.

Example 2 – Salvage Value

You purchase a laptop computer for €3,000. You expect the laptop to last 36 months and be worth €150 at the end of the three years.

| Formula | Description | Result |

=DB(3000,150,36,11) | Depreciation expense for month 11 | €104 |

Live Example in Sheets

Go to this spreadsheet for a live version of the DB function that you can study and use anywhere you want.